The ERP system Dynamics Business Central (formerly known as Dynamics NAV/Navision) is a solution that Microsoft sells globally, in dozens of countries. Each country has its own specific tax and accounting regulations and some business customs, and for this reason the solution cannot be sold as-is everywhere; it requires country-specific adaptations. This is where localizations come in, meaning those functionalities that are created specifically to meet the requirements of a particular country.

In Romania, Business Central partners have each developed their own localization package, which they include in their implementations or offer separately. There is some room for interpretation regarding what a localization package should or should not contain, which means that localizations differ from partner to partner. Therefore, in this article, we will describe what a localization package should contain and how you can differentiate between partners in terms of the quality of the localizations they offer. In short, a localization should have:

- Interface in the Romanian language

- Financial and accounting reports

- Working documents

- Tax declarations

- Closing functionalities

- Other optional functionalities

- User manual for the localization.

Interface in the Romanian language

A localization for the Romanian market should provide users with a user interface in the Romanian language. However, in the case of Business Central localizations, this interface can be a differentiator in choosing a localization package from one partner or another. Why? To answer this question, let’s make a brief historical digression. In Romania, initially, the product localization (including translation) was provided by Microsoft, but Microsoft stopped offering localization, and starting with Dynamics NAV 2013 version each partner had to translate all the new functionalities added to the product over time. Since we are dealing with terminology at the crossing of information technology and business processes, translation is not easy and requires a good understanding of both domains. Therefore, the quality of translation varies from partner to partner.

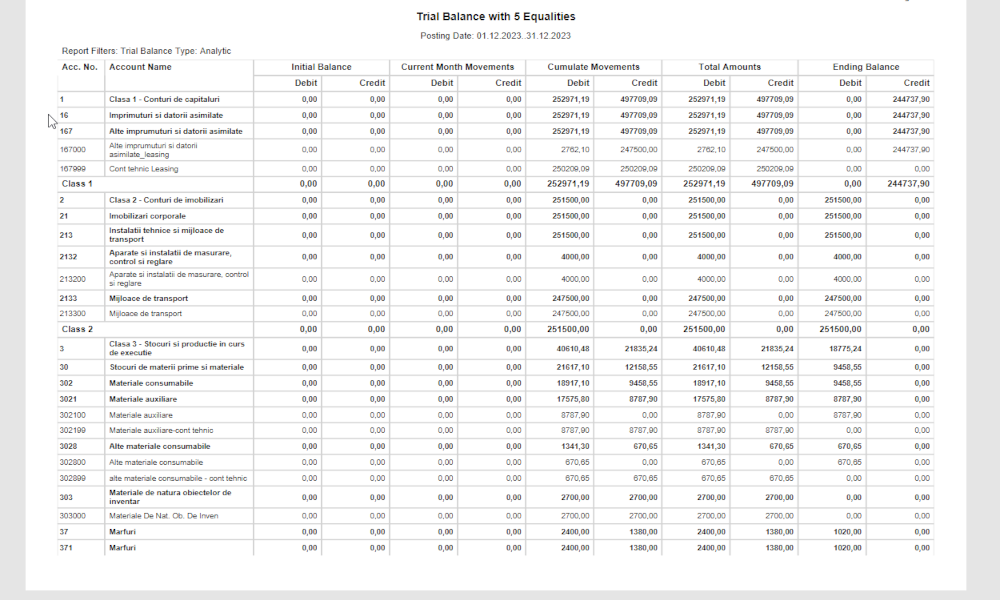

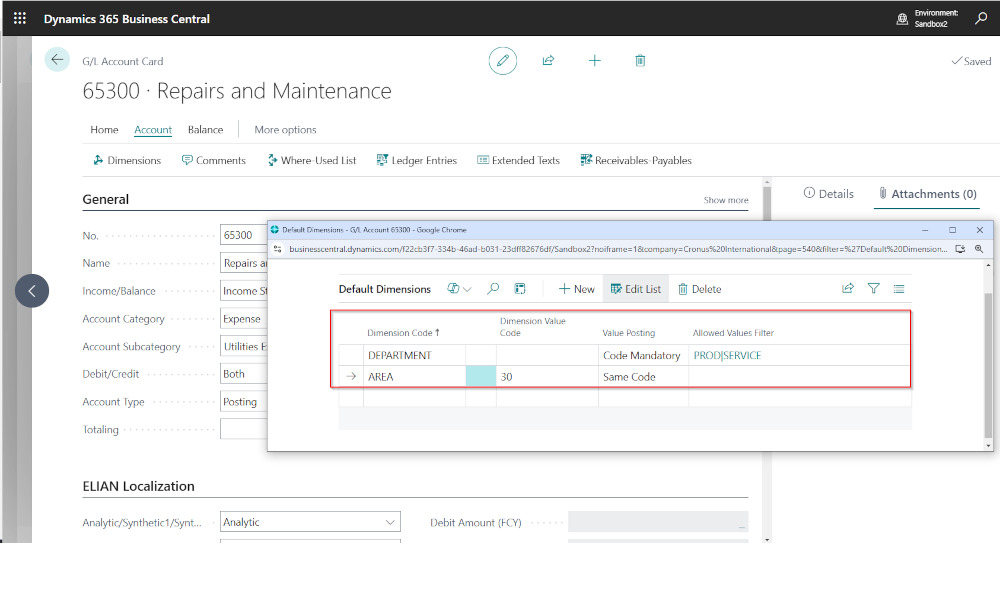

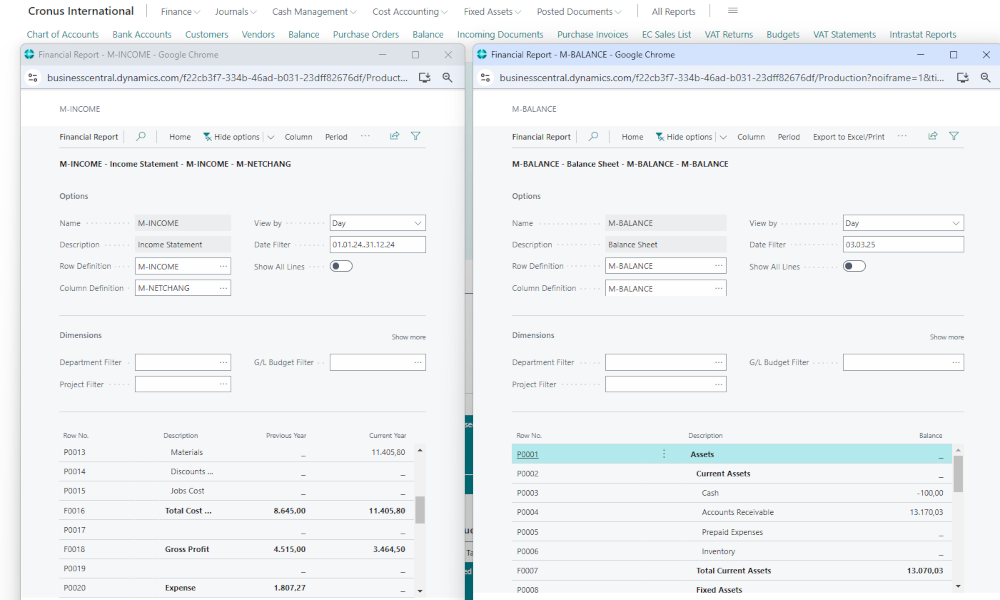

Financial reports

This category includes frequently used reports found in all accounting software programs, such as trial balance, register ledger, fixed asset register, cash journal, VAT journals and more. Localization packages differ in this area because there is no standardization in terms of the exact content of this set of reports; some are considered absolutely necessary and cannot be omitted from any financial accounting application, for example a trial balance with 5 equalities. However, others reports, such as the report for compensating receivables and liabilities, may be considered “optional.”

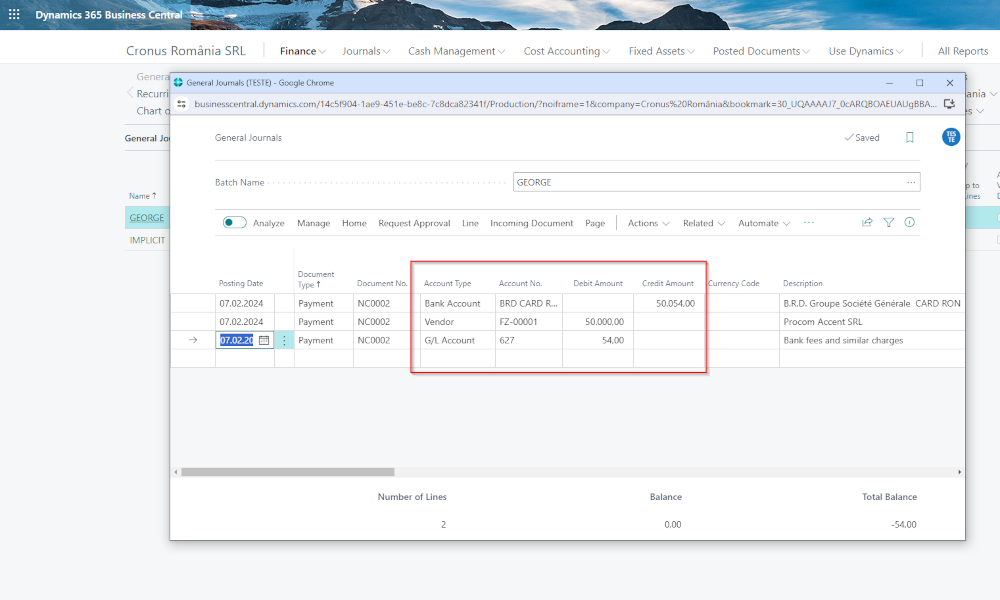

Transactional documents

Transactional documents are those that reflect various transactions, such as invoices, receipts, delivery notes, etc. As mentioned earlier, it is up to the partner whether to include certain reports or not, as some are considered more “necessary” than others. In this case, differentiation between partner localization packages can be made not so much in terms of content, which is regulated by legislation and conventions, but through design: fonts and layout.

Tax declarations

These are documents that must be submitted to tax authorities, such as Declaration 394, Intrastat Declaration, VIES Declaration, SAF-T, e-Invoice etc. A differentiation between partners can be made too, as the same reporting can be technically achieved in several ways, and some solutions may be quicker or easier to use.

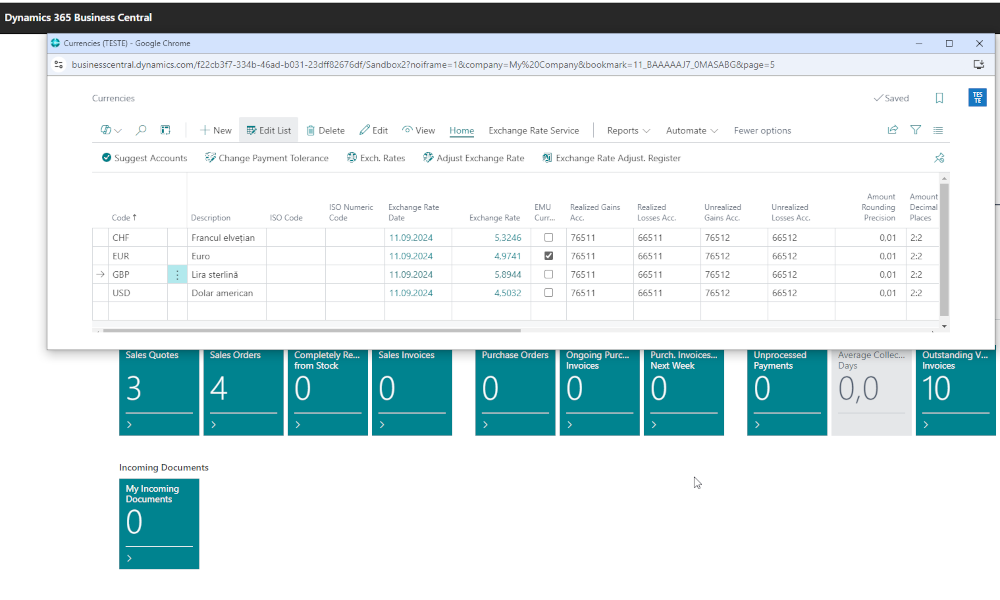

Closing incomes and expenses functionalities

In the ERP system Dynamics Business Central, the standard operation for closing incomes and expenses can only be done annually. Therefore, localization packages include the option for monthly closing of revenue and expense accounts. For monthly closings, there are also modifications to standard functionalities concerning exchange rate adjustments for foreign currency receivables and liabilities. And by the way, in the localization provided by Elian Solutions, there is a “Closing Page” that groups all the functionalities, journals, and declarations necessary for the accounting closing process.

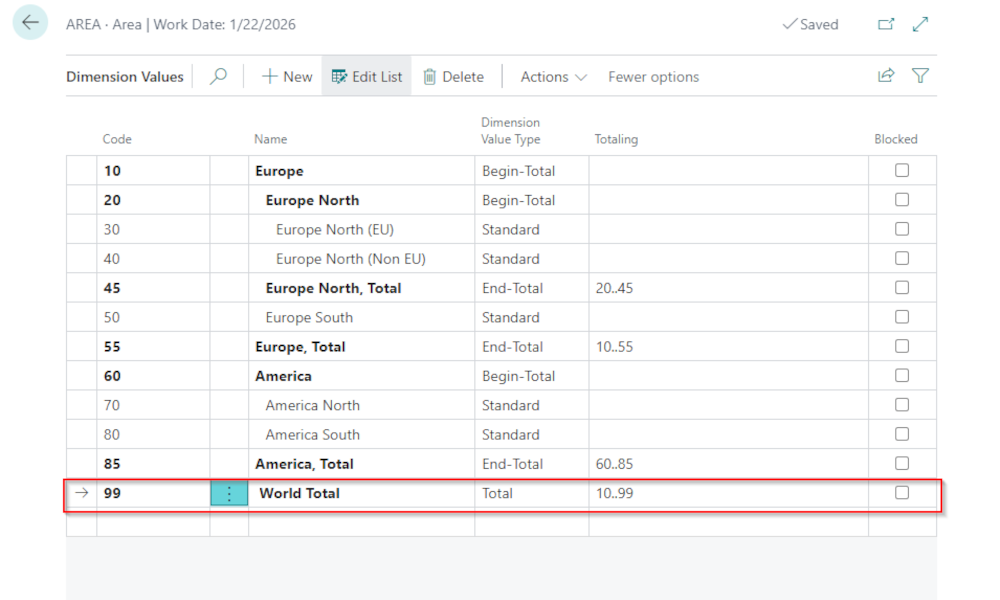

Other optional functionalities

Typically, in addition to the strictly necessary functionalities for localization, localization packages may also include some optional elements that help users automate certain operations or add extra functionality to the system. The localization package from Elian Solutions includes functionalities such as the option to query the web portal of ANAF (the National Agency for Fiscal Administration) for verifying and updating company data, functionality for importing bank statements, calculating late payment penalties and notifying customers etc.

User manual for the localization

Obviously, to work with localization, a manual describing the functionalities included in the localization is necessary: how to run reports and procedures, as well as various Business Central configuration options that, even though related to the system’s standard functionalities, must be adapted to Romanian tax and accounting requirements.

We hope we’ve managed to give you an idea of what a Business Central localization should contain. If you’re interested in the localization offered by Elian Solutions, you can see its content on the Romanian Business Central Localization page.

Elian Solutions is part of the Bittnet Group, active for over 15 years as an implementer of the Microsoft Dynamics 365 Business Central ERP system. With a team of over 70 employees and a portfolio of over 250 clients, Elian Solutions is one of the key Microsoft partners for ERP systems.